Professional Documents

Culture Documents

Interest and Annuity

Uploaded by

Mrinal Kanti DasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Interest and Annuity

Uploaded by

Mrinal Kanti DasCopyright:

Available Formats

Interest

Suppose A & B two business man. They are doing

business. When A borrows money from B, then A has

to pay certain amount of money to B for the use of the

money. The amount paid by A is called Interest.

Here borrowed amount is principal

Interest can be divided in two category:

1. Simple interest

2. compound interest

Simple interest

When interest is payable on the principal only, it is

called simple interest.

If I denotes the interest on a principal P at an interest

rate of r per year for n years, then we have

I = Pnr

The accumulated amount A, the sum of the principal

and interest after n years is given by

A = P + I = P + Prn

= P(1 + rn)

Compound Interest

Frequently, interest earned is periodically added to the

principal and thereafter earns interest itself at the

same rate. This is called compound interest.

Formula:

I= P(1+r)

n

Where I= compound interest, P=principal amount

r=rate of interest, n=number of year.

Annuity

An annuity is a series of payment , ordinarily of a fixed

amount payable regularly at equal intervals.

The intervals may be a year, a half year, a month and so

on.

Annuity Certain

(Payments are to be made for

a certain or fixed number of

years)

Annuity Contingent

(Payments are to be made till the

happening of some contingent

event such as the death of a

person, marriage of a girl ete.)

Annuity due

(Where the first payment

falls due at the beginning

of the ist interval, and so

on)

Annuity immediate

(Where the first

payment falls due at the

end of the first interval,

and so on)

Annuity

Different types of

annuities

Calculation of different types of annuities:

1. Formula for the present value of an Annuity

due

( )

( )

years of Number

interest of Rate

Annuity

due Annuity an of value Present

where

=

=

=

=

)

`

+

+

+ =

n

i

A

V

i

i

i

i

A

V

n

,

1

1

1 1

2. Formula for the present value of an Immediate Annuity

( )

(

+

=

n

i

i

A

V

1

1

1

3. Formula for the amount of an Immediate Annuity

( ) { } 1 1 + =

n

i

i

A

M

4. Formula for the amount of Annuity due

( ) ( ) { } 1 1 1 + + =

n

i i

i

A

M

5. Present Value of an Annuity

The present value of an Annuity is the sum of the present

values of its installments.

Business applicability

A man borrows Tk. 6000 at 6% and promises to pay off the

loan in 20 annual payments beginning at the end of the first

year. What is the annual payment necessary?

( )

(

+

=

n

i

i

A

V

1

1

1

know, We

, where

V = Present value

A = Annuity (annual payment)

i = Rate of interest

n = Number of years

?

20

06 . 0

100

6

000 , 6 ,

=

=

= =

=

A

n

i

V Here

( )

( )

19 . 523

19 . 523

206 . 2

206 . 3 06 . 0 6000

206 . 3

206 . 2

06 . 0

206 . 3

1 206 .. 3

06 . 0

206 . 3

1

1

06 . 0

06 . 1

1

1

06 . 0

06 . 0 1

1

1

06 . 0

6000

20

20

Tk. is necessary payment annual The

=

=

=

=

(

=

(

=

(

+

=

A

A

A

A

A

A

Log (1.06)

20

= 20 log 1.06

=200.0253

=0.506

Antilog 0.506

=3.206

(1.06)

20

=3.206

You might also like

- Engineering EconomyDocument159 pagesEngineering EconomyAlbert Aguilor88% (8)

- ANNUITIESDocument23 pagesANNUITIESJonalyn Bautista-CanlasNo ratings yet

- Simple AnnuityDocument28 pagesSimple AnnuityKelvin BarceLon33% (3)

- Angel InvestorDocument2 pagesAngel InvestorThuận Lê100% (1)

- Simple Annuity DueDocument3 pagesSimple Annuity Duefamous boy357No ratings yet

- Chapter 11 Foreign ExchangeDocument55 pagesChapter 11 Foreign ExchangeAfzal Kabir DipuNo ratings yet

- ISDA Equities Derivatives 2011 DefinitionsDocument333 pagesISDA Equities Derivatives 2011 Definitionsdafoozz100% (2)

- Present Value of An AnnuityDocument8 pagesPresent Value of An AnnuityirisNo ratings yet

- C3 Principles of Interest Annuity Due PerpetuityDocument87 pagesC3 Principles of Interest Annuity Due PerpetuityErroll Joshua Matusalem FonteNo ratings yet

- 4.2. AnnuitiesDocument7 pages4.2. AnnuitiesIsagaki RikuNo ratings yet

- ISAK 35 Non Profit Oriented EntitiesDocument48 pagesISAK 35 Non Profit Oriented Entitiesnabila dhiyaNo ratings yet

- Goldilocks-All Bout GoldilocksDocument13 pagesGoldilocks-All Bout GoldilocksCharisse Nhet Clemente64% (14)

- Engineering Economy Module 2Document33 pagesEngineering Economy Module 2James ClarkNo ratings yet

- List of Current AssetsDocument2 pagesList of Current AssetsMrinal Kanti Das100% (1)

- AnnuityDocument10 pagesAnnuityjabstretNo ratings yet

- AnnuityDocument8 pagesAnnuityDiego Silvano J. BarrosNo ratings yet

- HSBC HK Inward-PaymentsDocument2 pagesHSBC HK Inward-PaymentsBenedict Wong Cheng WaiNo ratings yet

- Valaution ICAI 3 PDFDocument132 pagesValaution ICAI 3 PDFhindustani888No ratings yet

- Homework: Working Capital Management 2021coardbulji: ActivityDocument3 pagesHomework: Working Capital Management 2021coardbulji: ActivityMa Teresa B. CerezoNo ratings yet

- Rural Bank of Lipa vs. CA (366 SCRA 740)Document2 pagesRural Bank of Lipa vs. CA (366 SCRA 740)Rivera Meriem Grace MendezNo ratings yet

- Hupseng CompletedDocument23 pagesHupseng CompletedX Wei LingNo ratings yet

- Unit 4 - AnnuityDocument5 pagesUnit 4 - AnnuityShashank HundiaNo ratings yet

- Section 1.9.1 Annuity-ImmediateDocument15 pagesSection 1.9.1 Annuity-ImmediateMary Dianneil MandinNo ratings yet

- Annuity NotesDocument8 pagesAnnuity NotesXohaib LeghariNo ratings yet

- Financial MGMT, Ch3Document29 pagesFinancial MGMT, Ch3heysemNo ratings yet

- AnnuityDocument52 pagesAnnuityGoldey Fetalvero MalabananNo ratings yet

- Time Value of Money: Mortgage Is A Loan in Which Property or Real Estate Is Used As Collateral. The BorrowerDocument4 pagesTime Value of Money: Mortgage Is A Loan in Which Property or Real Estate Is Used As Collateral. The BorrowerKartheek PoluNo ratings yet

- Financial ManagementDocument9 pagesFinancial Managementfirankisan1313No ratings yet

- FIN 3331 Managerial Finance: Time Value of MoneyDocument23 pagesFIN 3331 Managerial Finance: Time Value of MoneyHa NguyenNo ratings yet

- Fundamental of Financial Management: Tutorial: Time Value of MoneyDocument5 pagesFundamental of Financial Management: Tutorial: Time Value of MoneyNguyễn Hải LongNo ratings yet

- The Time Value of MoneyDocument26 pagesThe Time Value of MoneykidusNo ratings yet

- Chapter 3 Time Value of Money PDFDocument16 pagesChapter 3 Time Value of Money PDFmuluken walelgnNo ratings yet

- Ordinary Annuity ModuleDocument27 pagesOrdinary Annuity ModuleVincent Andrei Dela CruzNo ratings yet

- Economics For EngineersDocument11 pagesEconomics For EngineersUdop CharlesNo ratings yet

- Engineering EconomyDocument10 pagesEngineering EconomyFrancis Nano FerrerNo ratings yet

- Financial Management 1Document20 pagesFinancial Management 1Sriram_VNo ratings yet

- Assignment 1558589300 SmsDocument26 pagesAssignment 1558589300 Smspreciousfrancis365No ratings yet

- Ekonomi TeknikDocument4 pagesEkonomi TeknikRyan TitoNo ratings yet

- Time Value of MoneyDocument33 pagesTime Value of MoneySayantan HalderNo ratings yet

- Financial Mathematics 1 NotesDocument20 pagesFinancial Mathematics 1 NotesLukong LouisNo ratings yet

- ManagmentDocument91 pagesManagmentHaile GetachewNo ratings yet

- Chapter 4 The Time Value of MoneyDocument39 pagesChapter 4 The Time Value of MoneyQuỳnh NguyễnNo ratings yet

- Mathematics of Investment Chapter 4Document58 pagesMathematics of Investment Chapter 4Kayzel Ann SeloricoNo ratings yet

- Time Value of MoneyDocument52 pagesTime Value of MoneyJasmine Lailani ChulipaNo ratings yet

- Topic 3 ValuationDocument44 pagesTopic 3 Valuationbrianmfula2021No ratings yet

- Financial Management Time Value of Money Lecture 2,3 and 4Document12 pagesFinancial Management Time Value of Money Lecture 2,3 and 4Rameez Ramzan Ali67% (3)

- Week 4 General Annuity Take AwayDocument9 pagesWeek 4 General Annuity Take AwayJohn Daniel AntolinNo ratings yet

- Compound Interest: Formula: A P (1+r/t) (NT)Document3 pagesCompound Interest: Formula: A P (1+r/t) (NT)Logez BoxerNo ratings yet

- Financial Management Time Value of Money Lecture 2 3 and 4Document12 pagesFinancial Management Time Value of Money Lecture 2 3 and 4Kratika Pandey SharmaNo ratings yet

- 06 - Slide Time Value of Money #2 ShareDocument43 pages06 - Slide Time Value of Money #2 ShareyuditoktanelNo ratings yet

- FM I CH IiiDocument8 pagesFM I CH IiiDùķe HPNo ratings yet

- Chapter 5 Ppt-DonusturulduDocument46 pagesChapter 5 Ppt-DonusturulduOmer MehmedNo ratings yet

- Financial Mathematics Course FIN 118 Unit Course 10 Number Unit Ordinary Annuity Annuity Due Unit SubjectDocument26 pagesFinancial Mathematics Course FIN 118 Unit Course 10 Number Unit Ordinary Annuity Annuity Due Unit Subjectayadi_ezer6795No ratings yet

- 4 - AnnuityDocument13 pages4 - AnnuityAngel GraceNo ratings yet

- Compound Interest and Compound DiscountDocument51 pagesCompound Interest and Compound DiscountAllya CaveryNo ratings yet

- Chapter 4Document69 pagesChapter 4xffbdgngfNo ratings yet

- Bus Fin Module 4 Basic Long-Term Financial ConceptsDocument21 pagesBus Fin Module 4 Basic Long-Term Financial ConceptsMariaShiela PascuaNo ratings yet

- Chapter 4 The Time Value of MoneyDocument39 pagesChapter 4 The Time Value of Moneytrần thị ngọc trâmNo ratings yet

- 03 How To Calculate Present ValuesDocument15 pages03 How To Calculate Present Valuesddrechsler9No ratings yet

- FM I Chapter 3Document12 pagesFM I Chapter 3mearghaile4No ratings yet

- Types of AnnuitDocument3 pagesTypes of AnnuitRico LibagNo ratings yet

- Simple and Compound Interest: Concept of Time and Value OfmoneyDocument11 pagesSimple and Compound Interest: Concept of Time and Value OfmoneyUnzila AtiqNo ratings yet

- Consumer Mathematics: Gwendolyn TadeoDocument14 pagesConsumer Mathematics: Gwendolyn TadeoproximusNo ratings yet

- Engineering Economics: Ali SalmanDocument15 pagesEngineering Economics: Ali SalmanZargham KhanNo ratings yet

- Lecture Notes For Chapter 13Document34 pagesLecture Notes For Chapter 13Raazia ImranNo ratings yet

- Simple and Compound Interest: EC - Lec 07Document12 pagesSimple and Compound Interest: EC - Lec 07Junaid YNo ratings yet

- Eseneco L2Document5 pagesEseneco L2Jennifer Elizabeth Yambao100% (1)

- EconLM PDFDocument19 pagesEconLM PDFArnel Pamaos Lopiba MontañezNo ratings yet

- Chapter 4. The Time Value of Money and Discounted Cash Flow AnalysisDocument15 pagesChapter 4. The Time Value of Money and Discounted Cash Flow Analysisw4termel0n33No ratings yet

- Why Does Conflict OccurDocument2 pagesWhy Does Conflict OccurMrinal Kanti DasNo ratings yet

- Assignment Ratio AnalysisDocument7 pagesAssignment Ratio AnalysisMrinal Kanti DasNo ratings yet

- List of Current LiabilityDocument2 pagesList of Current LiabilityMrinal Kanti DasNo ratings yet

- Prepare A Bank Reconciliation Statement of Ahmed-18Document1 pagePrepare A Bank Reconciliation Statement of Ahmed-18Mrinal Kanti DasNo ratings yet

- Sources of FinanceDocument8 pagesSources of FinanceMrinal Kanti DasNo ratings yet

- WALLMART Latest Financial StatementDocument3 pagesWALLMART Latest Financial StatementMrinal Kanti DasNo ratings yet

- ClauseDocument1 pageClauseMrinal Kanti DasNo ratings yet

- What Is The Role of Management Information SystemDocument5 pagesWhat Is The Role of Management Information SystemMrinal Kanti DasNo ratings yet

- Insurance ACt 2010 Section 2Document3 pagesInsurance ACt 2010 Section 2Mrinal Kanti DasNo ratings yet

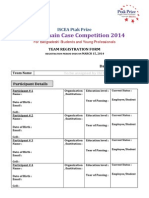

- Supply Chain Case Competition 2014Document2 pagesSupply Chain Case Competition 2014Shamsul Alam SajibNo ratings yet

- ShakilDocument1 pageShakilMrinal Kanti DasNo ratings yet

- Quesstionnaire On BD Labor ACT 2006Document25 pagesQuesstionnaire On BD Labor ACT 2006Mrinal Kanti DasNo ratings yet

- Agency ProblemDocument1 pageAgency ProblemMrinal Kanti Das100% (1)

- Models of The Communication ProcessDocument13 pagesModels of The Communication ProcessMrinal Kanti DasNo ratings yet

- Assignment On Introduction To Banking: Course: Theory and Practices of Banking (1203)Document24 pagesAssignment On Introduction To Banking: Course: Theory and Practices of Banking (1203)Mrinal Kanti DasNo ratings yet

- Welcome To Our PresentationDocument23 pagesWelcome To Our PresentationMrinal Kanti DasNo ratings yet

- CommunicationDocument7 pagesCommunicationMrinal Kanti DasNo ratings yet

- CHAPTER 3 Banker Customer Relationship Rights of A BankDocument8 pagesCHAPTER 3 Banker Customer Relationship Rights of A BankCarl AbruquahNo ratings yet

- PARCOR DiscussionDocument6 pagesPARCOR DiscussionSittiNo ratings yet

- Ratio Analysis: Interpretation of Financial Statements: 1) Profitability RatiosDocument4 pagesRatio Analysis: Interpretation of Financial Statements: 1) Profitability RatiosCollen MahamboNo ratings yet

- Annexa Prime Trading CoursesDocument11 pagesAnnexa Prime Trading CoursesFatima FX100% (1)

- Prime Bank Project ReportDocument96 pagesPrime Bank Project ReporttoxictouchNo ratings yet

- For ClosureDocument18 pagesFor Closuremau_cajipeNo ratings yet

- Accounting II BBA 3rdDocument9 pagesAccounting II BBA 3rdTalha GillNo ratings yet

- Figlewski Stephen - What Does An Option Pricing Model Tell Us About Option PricesDocument5 pagesFiglewski Stephen - What Does An Option Pricing Model Tell Us About Option PricesJermaine R BrownNo ratings yet

- Coinremitter Allows Merchants To Integrate APIDocument5 pagesCoinremitter Allows Merchants To Integrate APIPratik MehetaNo ratings yet

- Analysis On Foreign Exchange and Stock ReturnDocument64 pagesAnalysis On Foreign Exchange and Stock ReturnTeng Yee JingNo ratings yet

- An Analysis of The Budget of Bangladesh For The Fiscal Year 2015-16 Along With Its Previous Trend of Growth and ReductionDocument26 pagesAn Analysis of The Budget of Bangladesh For The Fiscal Year 2015-16 Along With Its Previous Trend of Growth and ReductionSekender AliNo ratings yet

- Netflix Inc.: Content Ramp Adding Torque To The FlywheelDocument30 pagesNetflix Inc.: Content Ramp Adding Torque To The FlywheelManvinder SinghNo ratings yet

- Assessing The Effect of Financial Literacy On SavingDocument7 pagesAssessing The Effect of Financial Literacy On SavingMarinette Valencia MedranoNo ratings yet

- Ketan Parekh ScamDocument2 pagesKetan Parekh Scamrehan husainNo ratings yet

- Three Perspectives On The Valuation of Derivative InstrumentsDocument10 pagesThree Perspectives On The Valuation of Derivative InstrumentsNiyati ShahNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Vamshi KrishnaNo ratings yet

- BellonDocument7 pagesBellonValeria Rendon NoyolaNo ratings yet

- LECTURE/ TUTORIAL 5, 6, 7 - Examples of Present Worth Methods Example-1Document8 pagesLECTURE/ TUTORIAL 5, 6, 7 - Examples of Present Worth Methods Example-1Veejay SalazarNo ratings yet

- Quiz 8 - BTX 113Document3 pagesQuiz 8 - BTX 113Rae Vincent Revilla100% (1)

- 14 - Simple Interest MODULE 6Document16 pages14 - Simple Interest MODULE 6Mabel LynNo ratings yet