Professional Documents

Culture Documents

Financial Accounting - BRS Mcqs

Uploaded by

Divya SriOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Accounting - BRS Mcqs

Uploaded by

Divya SriCopyright:

Available Formats

BANK RECONCILATION STATEMENT

1. Bank reconciliation statement is

__________

a) A ledger account

b) A part of cash book with bank column

c) A statement showing the causes of

difference between the cash book and pass book balances

d) All of the above

Answer: A statement showing the causes of difference between the cash book and pass book balances

2. Bank reconciliation statement may be

prepared with the balance of ________

a) Cash book

b) Pass book

c) Entire cash book or pass book

d) Neither cash book nor pass book

Answer: Entire cash book or pass book

3. Debit balance of pass book shows

__________

a) Deposit (plus) balance

b) Overdraft (minus) balance

c) Either deposit or overdraft balance

d) Neither deposit nor overdraft balance

Answer: Overdraft (minus) balance

4. Pass book is a ________ a) Copy of receipts and payment of the firm b) Copy of the firms ledger account

maintained by the bank

c) Copy of the bank transactions entered in

the cash book

d) Record of all transactions

Answer: Copy of the firms ledger account maintained by the bank

5. Overdraft facility is available only in

_________

a) Savings bank account

b) Current account

c) Recurring deposit account

d) Fixed deposit account

Answer: Current account

6. The bank balance is treated as plus

(deposit) balance, if it is a _________

a) Debit balance of cash book

b) Credit balance of pass book

c) Both a & b

d) Credit balance of cash book

Answer: Both a & b

7. Bank column in cash book shows a credit

balance. What does it mean?

a) There must be un-deposited cash

b) There is overdraft balance

c) There must be some error in recording

d) Cashier has embezzled cash

Answer: There is overdraft balance

8. A Bank reconciliation statement is

prepared to know the causes for difference between ____

a) The balance as per cash column of cash

book & pass book

b) The balance as per bank column of cash

book & pass book

c) Both a & b

d) Neither a or b

Answer: The balance as per bank column of cash book & pass book

9. A Bank reconciliation statement is

prepared by _________

a) Bank

b) Customer of the bank

c) Creditors

d) Government

Answer: Customer of the bank

10. A Bank reconciliation statement is

prepared with the help of __________

a) Bank pass book and bank column of cash

book

b) Bank pass book and cash column of cash

book

c) Bank pass book and petty cash book d) All the above

Answer: Bank pass book and bank column of cash book

11. If you start with cash book deposit

balance in the Bank reconciliation statement, which item or items will you add?

a) Cheques issued but not yet presented for

payment

b) Amounts directly deposited by the

customer into bank

c) Interest allowed by the bank

d) All the above

Answer: All the above

12. If you start with cash book deposit

balance in the Bank reconciliation statement, which item or items will you deduct?

a) Dishonored cheque

b) Discounted bills dishonored

c) Dividend on shares collected by bank

d) Both a & b

Answer: Both a & b

13. The main purpose of preparing a Bank

reconciliation statement is ________

a) To know cash book balance

b) To know pass book balance

c) To compare the transactions in the cash

book and pass book

d) To reconcile balance as per cash book with

the pass book

Answer: To reconcile balance as per cash book with the pass book

14. Bank reconciliation statement is a

_________

a) Separate statement

b) Ledger account

c) Sub division of journal

d) Part of cash book

Answer: Separate statement

15. Unfavorable bank balance means

_________

a) Debit balance in cash book

b) Debit balance in pass book

c) Credit balance in cash book

d) Both b & c

Answer: Both b & c

16. A cheque received and deposited in the

bank on the same day is recorded in the _________

a) Bank column of cash book

b) Cash column of cash book

c) Both a & b

d) Discount column of cash book

Answer: Bank column of cash book

17. An amount of Rs. 5000 is debited twice

in the pass book. When overdraft balance as per the cash book is the starting point _______

a) Rs. 5000 will be added b) Rs. 5000 will be deducted c) Rs. 10000 will be added d) Rs. 10000 will be deducted

Answer: Rs. 5000 will be added

18. Which one of the following statements is false? a) Pass book is a copy of customers account in the

ledger of the bank

b) Normally, if the pass book shows credit balance, the

cash book shows debit balance

c) Unfavorable bank balance means debit balance in

pass book and credit balance in cash book

d) Unfavorable bank balance means credit balance in

pass book and debit balance in cash book

Answer: Unfavorable bank balance means credit balance in pass book and debit balance in cash book

19. Which one of the following statements

is false?

a) Debit balance in pass book means overdraft

b) Bank passbook is a copy of customers

account in the books of bank

c) For a dishonored cheque, bank account is

debited

d) Debit entry in pass book means a credit

entry in cash book

Answer: For a dishonored cheque, bank account is debited

You might also like

- CPT Bank Reconciliation StatementDocument7 pagesCPT Bank Reconciliation StatementIqra Mughal60% (5)

- Fixed assets depreciation MCQs and trial balance quizDocument5 pagesFixed assets depreciation MCQs and trial balance quizMahesh Jagadale0% (1)

- Top Senior Auditor Solved MCQs Past PapersDocument12 pagesTop Senior Auditor Solved MCQs Past PapersAli100% (1)

- MGT402 Cost & Management Accounting Midterm ExamDocument279 pagesMGT402 Cost & Management Accounting Midterm ExamRamchandra MurthyNo ratings yet

- Accounting Basics MCQsDocument16 pagesAccounting Basics MCQsKS JagadishNo ratings yet

- Mcs QDocument52 pagesMcs QNabeel GondalNo ratings yet

- Sem5 MCQ MangACCDocument8 pagesSem5 MCQ MangACCShirowa ManishNo ratings yet

- Accounting & Auditing MCQs from Past PapersDocument15 pagesAccounting & Auditing MCQs from Past PapersFahad RazaNo ratings yet

- Multiple Choices - Fin081Document2 pagesMultiple Choices - Fin081RovicNo ratings yet

- Economics MCQs BankDocument49 pagesEconomics MCQs BankMuhammad Nadeem SarwarNo ratings yet

- Account MCQ PDFDocument93 pagesAccount MCQ PDFsunil kalura100% (1)

- MCQsDocument3 pagesMCQsMalik ArshadNo ratings yet

- Account MCQ Notes PDFDocument26 pagesAccount MCQ Notes PDFShakib AnsariNo ratings yet

- MCQ FA (UNIT 1 and UNIT 2)Document13 pagesMCQ FA (UNIT 1 and UNIT 2)Udit SinghalNo ratings yet

- Multiple Choice Questions: Journal - The First Phase of Accounting CycleDocument4 pagesMultiple Choice Questions: Journal - The First Phase of Accounting CycleDohaa NadeemNo ratings yet

- Accounting 1 Exam Questions for COMSATS Institute StudentsDocument11 pagesAccounting 1 Exam Questions for COMSATS Institute StudentsFami FamzNo ratings yet

- ACCOUNTING - MCQS - BY - PAKMCQS - PAGE - 1-59.pdf Filename UTF-8''ACCOUNTING MCQS BY PAKMCQS PAGE 1-59Document59 pagesACCOUNTING - MCQS - BY - PAKMCQS - PAGE - 1-59.pdf Filename UTF-8''ACCOUNTING MCQS BY PAKMCQS PAGE 1-59Muhammad WasimNo ratings yet

- Economics McqsDocument12 pagesEconomics McqsPeer Saeed Tahir Bodla100% (2)

- MCQ - BasicDocument22 pagesMCQ - BasicLalitNo ratings yet

- MCQDocument20 pagesMCQSujeet GuptaNo ratings yet

- Public Goods, Externalities, and Information Asymmetries: Multiple Choice QuestionsDocument52 pagesPublic Goods, Externalities, and Information Asymmetries: Multiple Choice QuestionsYannah HidalgoNo ratings yet

- Cs Cost MCQ Part 11Document60 pagesCs Cost MCQ Part 11Tabish RehmanNo ratings yet

- Befa MCQ 50Document9 pagesBefa MCQ 505A2 NUKALA MEGHANANo ratings yet

- MCQS Trail BalanceDocument2 pagesMCQS Trail BalanceSai KrishnaNo ratings yet

- MCQs on Non-Profit Accounting FundamentalsDocument6 pagesMCQs on Non-Profit Accounting Fundamentalsbobby AggarwalNo ratings yet

- CA CPT Accountancy Sample QuestionsDocument11 pagesCA CPT Accountancy Sample QuestionsyuthikasNo ratings yet

- FPSC Senior Auditor TestDocument2 pagesFPSC Senior Auditor TestIftikhar AhmadNo ratings yet

- Accounting Mcqs For PPSCDocument5 pagesAccounting Mcqs For PPSCizhar_buneriNo ratings yet

- Marginal MCQDocument10 pagesMarginal MCQDivya SriNo ratings yet

- Unit 1: Indian Financial System: Multiple Choice QuestionsDocument31 pagesUnit 1: Indian Financial System: Multiple Choice QuestionsNisha PariharNo ratings yet

- NPO MCQ QuestionDocument5 pagesNPO MCQ QuestionBikash SahooNo ratings yet

- Accounting/Finance M.C.Qs PreparationDocument11 pagesAccounting/Finance M.C.Qs Preparationkarim mawazNo ratings yet

- Ugc Net Solved Paper Commerce Paper Ii J0810Document8 pagesUgc Net Solved Paper Commerce Paper Ii J0810Raajkuumar Khatri100% (3)

- Financial Accounting MCQs - Senior Auditor Bs-16Document34 pagesFinancial Accounting MCQs - Senior Auditor Bs-16Faizan Ch0% (1)

- MCQ EABD Unit 1Document15 pagesMCQ EABD Unit 1Preet JainNo ratings yet

- Economics Practice MCQ Page 1Document2 pagesEconomics Practice MCQ Page 1TARIQKHAN747No ratings yet

- Accounting Concepts and Conventions MCQs Financial Accounting MCQs Part 2 Multiple Choice QuestionsDocument9 pagesAccounting Concepts and Conventions MCQs Financial Accounting MCQs Part 2 Multiple Choice QuestionsKanika BajajNo ratings yet

- O B McqsDocument3 pagesO B McqsYousaf JamalNo ratings yet

- Rectification of ErrorsDocument23 pagesRectification of ErrorsSarthak GuptaNo ratings yet

- Accounting McqsDocument16 pagesAccounting McqsAsad RehmanNo ratings yet

- Accounting Mcqs 3Document6 pagesAccounting Mcqs 3Mohd AyazNo ratings yet

- Exit Model (Fundamental of Accounting)Document6 pagesExit Model (Fundamental of Accounting)aronNo ratings yet

- Balancing BOP: Expenditure PoliciesDocument34 pagesBalancing BOP: Expenditure Policieschanchal22No ratings yet

- Accounting Multiple Choice Questions#1: A) B) C) D)Document13 pagesAccounting Multiple Choice Questions#1: A) B) C) D)Gunjan RajdevNo ratings yet

- Audit B.com Part 2Document1 pageAudit B.com Part 2Ahmad Nawaz JanjuaNo ratings yet

- MCQs Management SciencesDocument194 pagesMCQs Management ScienceszeeshanNo ratings yet

- Financial Accounting Iii Sem: Multiple Choice Questions and AnswersDocument24 pagesFinancial Accounting Iii Sem: Multiple Choice Questions and AnswersRamya Gowda100% (1)

- MCQs On Cash Book & Ledgers PDFDocument11 pagesMCQs On Cash Book & Ledgers PDFHaroon Akhtar100% (1)

- Business Environment Q & ADocument16 pagesBusiness Environment Q & ASadaf NazneenNo ratings yet

- Economics McqsDocument56 pagesEconomics McqsAtif KhanNo ratings yet

- MCQ Set 2 - Intro to AccountingDocument3 pagesMCQ Set 2 - Intro to AccountingHsiu PingNo ratings yet

- Difference Between Classification and TabulationDocument30 pagesDifference Between Classification and TabulationThe State AcademyNo ratings yet

- Calicut University Microeconomics Question BankDocument10 pagesCalicut University Microeconomics Question BankAmitnprinceNo ratings yet

- MCQ Test AbdDocument3 pagesMCQ Test AbdRahul Ghosale100% (1)

- MGT101 Midterm ExamDocument78 pagesMGT101 Midterm ExamNaeem Khan100% (1)

- Journal, Ledger MCQDocument7 pagesJournal, Ledger MCQSujan DangalNo ratings yet

- Ratio Analysis McqsDocument10 pagesRatio Analysis McqsNirmal PrasadNo ratings yet

- Section 2 (4) Section 4 (2) Section 3 (1) Section 1 (3) A-CDocument5 pagesSection 2 (4) Section 4 (2) Section 3 (1) Section 1 (3) A-CNaqeeb Ur RehmanNo ratings yet

- Multiple Choice Questions on Accounting FundamentalsDocument10 pagesMultiple Choice Questions on Accounting FundamentalsChinmay Sirasiya (che3kuu)No ratings yet

- Answer: BDocument15 pagesAnswer: BTrinh LêNo ratings yet

- Profile of The CompanyDocument14 pagesProfile of The CompanyDivya SriNo ratings yet

- Guided - Unguided Transmission MediaDocument30 pagesGuided - Unguided Transmission MediaDivya SriNo ratings yet

- Marginal MCQDocument10 pagesMarginal MCQDivya SriNo ratings yet

- Guided - Unguided Transmission MediaDocument29 pagesGuided - Unguided Transmission MediaDivya SriNo ratings yet

- Class DiagramDocument12 pagesClass DiagramDivya SriNo ratings yet

- Mcqs On Software EngineeringDocument12 pagesMcqs On Software EngineeringDivya Sri88% (8)

- AugDocument3 pagesAugArjun Mishra0% (1)

- Monetary PolicyDocument31 pagesMonetary PolicyInderpreet KaurNo ratings yet

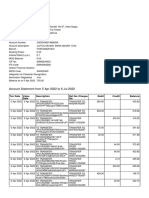

- Bank Statement: Bizdirect Contact Centre: 0860 109 075Document6 pagesBank Statement: Bizdirect Contact Centre: 0860 109 075GabrielNo ratings yet

- Intermediate Accounting 11th Edition Nikolai Test BankDocument61 pagesIntermediate Accounting 11th Edition Nikolai Test Bankesperanzatrinhybziv100% (27)

- Q CH 9Document7 pagesQ CH 9Jhon F SinagaNo ratings yet

- This Spreadsheet Supports Analysis of The Case, "Coleco Industries Inc." (Case 60)Document6 pagesThis Spreadsheet Supports Analysis of The Case, "Coleco Industries Inc." (Case 60)kashanr82No ratings yet

- Instructional Material FOR ECON 30063 Monetary Economics: Polytechnic University of The PhilippinesDocument9 pagesInstructional Material FOR ECON 30063 Monetary Economics: Polytechnic University of The PhilippinesMonicDuranNo ratings yet

- The Most Dangerous Organization in America ExposedDocument37 pagesThe Most Dangerous Organization in America ExposedDomenico Bevilacqua100% (1)

- Jackson Company Adopts Acceptable Accounting For Its Defined Benefit Pension Plan On January 31, 2011, With The Following Beginning BalancesDocument2 pagesJackson Company Adopts Acceptable Accounting For Its Defined Benefit Pension Plan On January 31, 2011, With The Following Beginning Balanceslaale dijaanNo ratings yet

- April JuneDocument15 pagesApril JuneSanjivNo ratings yet

- Paper 1-NISM X A - INVESTMENT ADVISER LEVEL 1 - PRACTICE TEST 1 - UnlockedDocument19 pagesPaper 1-NISM X A - INVESTMENT ADVISER LEVEL 1 - PRACTICE TEST 1 - UnlockedHirak Jyoti Das100% (1)

- Basis Trading BasicsDocument51 pagesBasis Trading BasicsTajinder SinghNo ratings yet

- Exercise 1 Investment in AssociatesDocument7 pagesExercise 1 Investment in AssociatesJoefrey Pujadas BalumaNo ratings yet

- Tutorial Chapter 3 Cash BudgetDocument12 pagesTutorial Chapter 3 Cash Budgetrayyan danNo ratings yet

- Submission NI Act and Artha Rin 13.03.2018Document21 pagesSubmission NI Act and Artha Rin 13.03.2018Shah Fakhrul Islam AlokNo ratings yet

- Andleeb Abbas - Declaration of Assets Liabilities - Dec 2013Document4 pagesAndleeb Abbas - Declaration of Assets Liabilities - Dec 2013PTI Official100% (1)

- Exchange Deed: Description of The DeedDocument3 pagesExchange Deed: Description of The DeedAdan HoodaNo ratings yet

- Control of The Money SupplyDocument2 pagesControl of The Money SupplyMario SarayarNo ratings yet

- Pollen DeFi Tokenomics 2.11.21Document1 pagePollen DeFi Tokenomics 2.11.21Sean BondNo ratings yet

- Compiler Additional Questions For Nov 22 ExamsDocument18 pagesCompiler Additional Questions For Nov 22 ExamsRobertNo ratings yet

- PartnershipDocument6 pagesPartnershipJoanne TolentinoNo ratings yet

- Sec - C - TVM 2019 - PW, FW, AW, GR, Nom-EffDocument4 pagesSec - C - TVM 2019 - PW, FW, AW, GR, Nom-EffNaveen KumarNo ratings yet

- Cafe Monte BiancoDocument21 pagesCafe Monte BiancoWilliam Torrez OrozcoNo ratings yet

- T04 - Profits TaxDocument18 pagesT04 - Profits Taxting ting shihNo ratings yet

- Skye Computer SolutionDocument3 pagesSkye Computer SolutionAashay Shah0% (2)

- Step-By-Step SBLC Transaction ProcedureDocument1 pageStep-By-Step SBLC Transaction ProcedureAmit DasNo ratings yet

- G1 (Sanket Awate) Pem PFSDocument5 pagesG1 (Sanket Awate) Pem PFSNirank JadhavNo ratings yet

- 10b Investment Property PDFDocument40 pages10b Investment Property PDFmEOW SNo ratings yet

- Riba Al Fadl: Understanding Prohibition of Excess in Exchange of CommoditiesDocument17 pagesRiba Al Fadl: Understanding Prohibition of Excess in Exchange of CommoditiesAsadNo ratings yet